Homeowners Insurance in and around Greenville

Looking for homeowners insurance in Greenville?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you rest, recharge and relax. It’s where you build a life with the ones you love.

Looking for homeowners insurance in Greenville?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

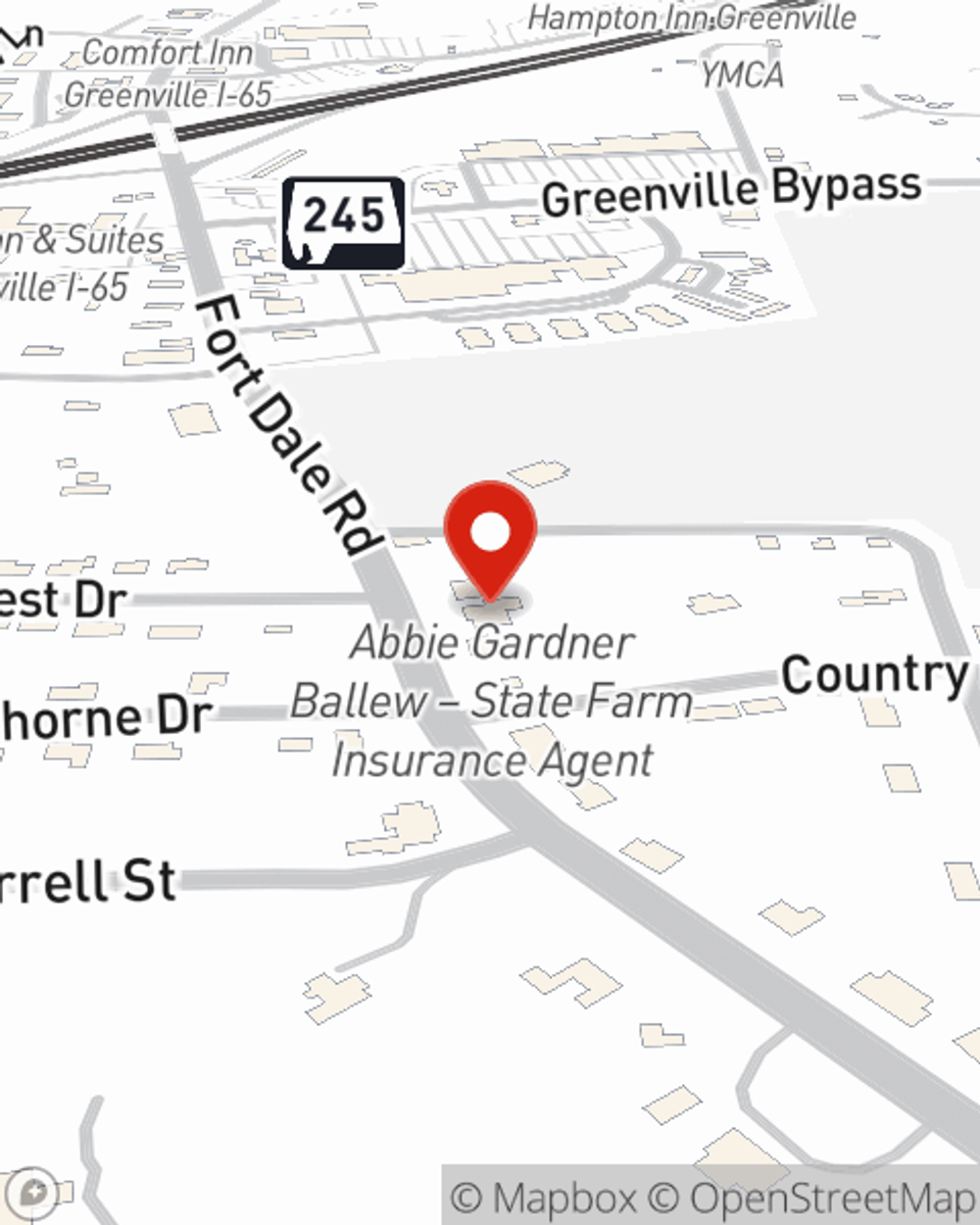

Abbie Gardner Ballew will help you feel right at home by getting you set up with reliable insurance that fits your needs. State Farm's homeowners insurance not only covers the structure of your home, but can also protect precious items like your pictures.

Whether you're prepared for it or not, the unforeseen can happen. But with State Farm, you're always prepared, so you can laugh and play knowing that your belongings are covered. Additionally, if you also insure your vehicle, you could bundle and save! Contact agent Abbie Gardner Ballew today to go over your options.

Have More Questions About Homeowners Insurance?

Call Abbie at (334) 382-6561 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

Abbie Gardner Ballew

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.