Business Insurance in and around Greenville

One of Greenville’s top choices for small business insurance.

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to take into account. We get it. State Farm agent Abbie Gardner Ballew is a business owner, too. Let Abbie Gardner Ballew help you make sure that your business is properly protected. You won't regret it!

One of Greenville’s top choices for small business insurance.

Helping insure small businesses since 1935

Cover Your Business Assets

If you're looking for a business policy that can help cover extra expense, computers, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

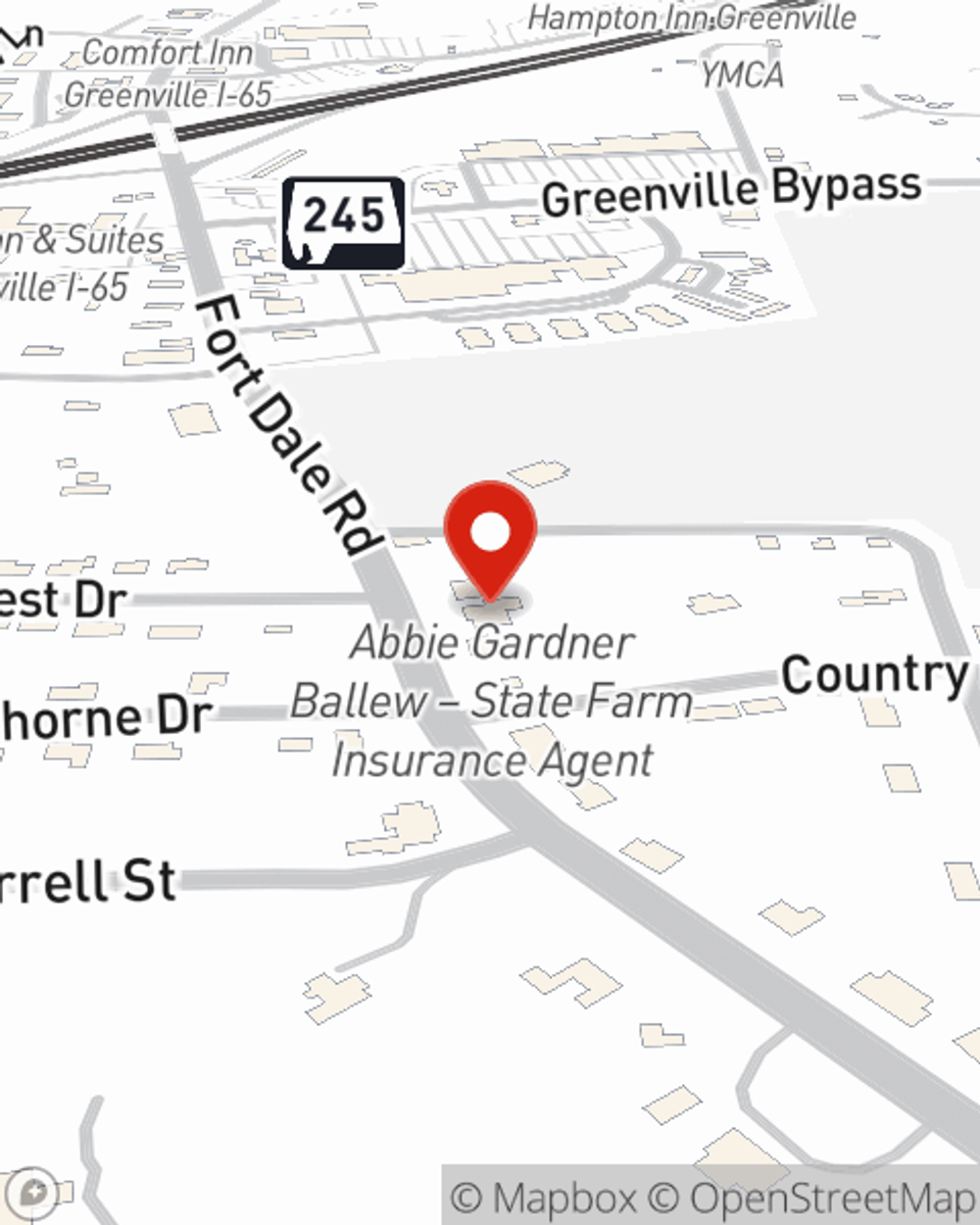

Get in touch with State Farm agent Abbie Gardner Ballew today to check out how a State Farm small business policy can safeguard your future here in Greenville, AL.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Abbie Gardner Ballew

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.